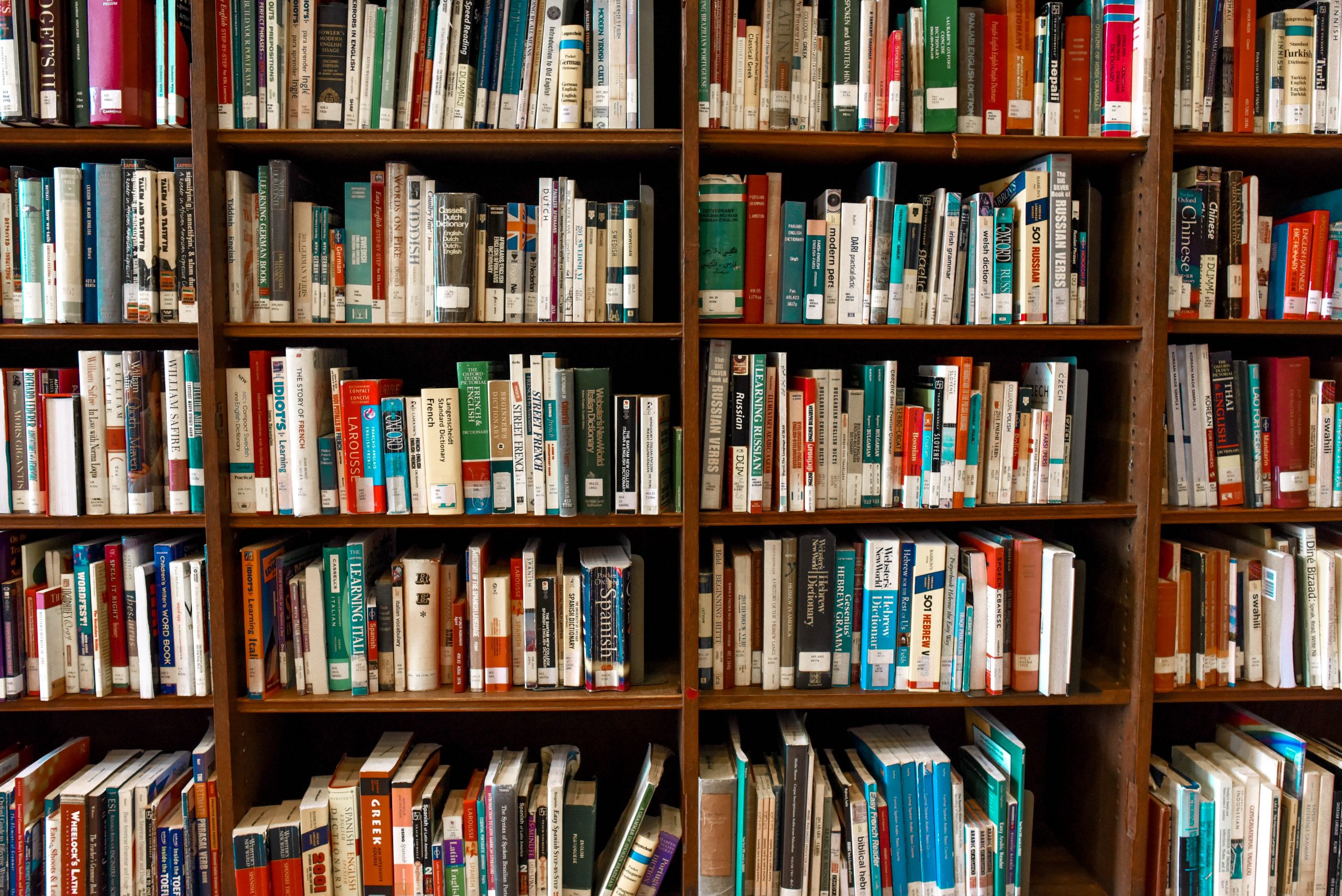

Dar Al-Hikmah Library

Dar-Al-Hikmah Library provide library services to IIUM Community. It has branches in all campuses.

Management Services Division

Management Services Division (MSD) is responsible for managing Human Resources in IIUM.

Information Technology Division

Information Technology Division (ITD) is responsible for managing IT in IIUM.